Mini split heat pump tax credit

Are you aware of the tax credits available for mini splits? If you have recently installed a mini-split heat pump or are considering doing so, you may be eligible for a tax credit. The mini-split heat pump tax credit is a government incentive aimed at promoting energy efficiency and reducing carbon emissions. This tax credit can help offset the cost of installing a mini-split system in your home or business.

So, do mini splits qualify for tax credit? The answer is yes! Mini-split heat pumps are considered air source heat pumps, which are eligible for the tax credit. The tax credit is available until the end of 2023, making it the perfect time to take advantage of this opportunity.

One popular brand that offers mini-split heat pumps eligible for the tax credit is Bosch. With their energy-efficient models, Bosch mini splits are an excellent choice for those looking to reduce their carbon footprint and save money on energy bills. By claiming the tax credit, you can further reduce the cost of a Bosch mini-split heat pump.

Don’t miss out on the opportunity to claim the mini split heat pump tax credit. Take advantage of this government incentive to enhance the energy efficiency of your home or business while saving money. Contact your local HVAC professional to find out more about how you can claim the tax credit and start enjoying the benefits of a mini-split heat pump today.

Save Money with Mini Split Heat Pump Tax Credit

If you’re considering installing a mini split heat pump in your home, now is the perfect time to take advantage of tax credits for mini splits. These tax credits can help you save money on your installation costs and make the investment even more affordable.

One of the top brands offering tax credits for mini splits is Bosch. With their tax credit program, you can receive a credit for up to 26% of the total cost of your project. This can make a significant dent in your expenses and help offset the upfront costs of your mini split heat pump.

Another important thing to note is the air source heat pump tax credit for 2023. This tax credit allows homeowners to receive a credit for up to 26% of the cost of their air source heat pump installation, including mini split systems. So, if you’re planning to install a mini split heat pump in the near future, you can take advantage of this tax credit and save even more money.

For those specifically interested in Mitsubishi mini split systems, you’ll be glad to know that they qualify for the tax credit as well. With a Mitsubishi mini split tax credit, you can save money on your installation while enjoying the benefits of their high-quality and energy-efficient systems.

But do mini-split systems qualify for tax credit? The answer is yes. Mini split systems are eligible for tax credits as long as they meet certain energy efficiency criteria. This is good news for homeowners who want to invest in a mini split heat pump and save money at the same time.

So, if you’re thinking about installing a mini split heat pump in your home, don’t miss out on the opportunity to save money with tax credits. Whether you choose Bosch, Mitsubishi, or any other brand, make sure to check with your local tax authority or consult a professional to ensure that you qualify for the tax credit.

What is a Mini Split Heat Pump?

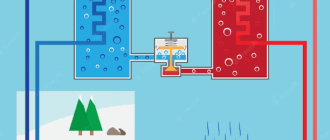

A mini split heat pump, also known as a ductless heat pump or mini split AC, is a heating and cooling system that is designed to provide both heating and cooling to individual rooms or zones within a building. Unlike traditional HVAC systems, mini split heat pumps do not require ductwork to distribute air, making them a flexible and cost-effective solution for heating and cooling.

Mini split heat pumps consist of two main components: an outdoor unit, also called the condenser, and one or more indoor units, also known as the evaporator or air handlers. The outdoor unit contains the compressor and other components that are responsible for transferring heat between the indoor and outdoor environments. The indoor units are mounted on walls or ceilings and are connected to the outdoor unit via refrigerant lines and electrical wiring.

One of the main advantages of mini split heat pumps is their energy efficiency. Most mini split systems are equipped with inverter technology, which allows them to adjust the speed of the compressor to match the heating or cooling demands of the space. This results in lower energy consumption and improved comfort compared to traditional HVAC systems.

Another advantage of mini split heat pumps is their ability to provide both heating and cooling. They can extract heat from the outdoor air during the winter and transfer it indoors to provide heating. In the summer, they can reverse the process and remove heat from the indoor air to provide cooling.

Now that you know what a mini split heat pump is, you may be wondering if they qualify for tax credits. The good news is that mini split heat pumps do qualify for tax credits, such as the air source heat pump tax credit 2023. This tax credit allows homeowners to claim a certain percentage of the cost of the mini split heat pump, including installation, up to a certain limit. The specific details of the tax credit may vary depending on your location and the brand of mini split heat pump you choose.

Popular mini split heat pump brands, such as Bosch, also offer their own tax credits and rebates to encourage homeowners to choose their products. These additional incentives can help to further offset the cost of installing a mini split heat pump.

In conclusion, mini split heat pumps are a versatile and energy-efficient solution for heating and cooling individual rooms or zones within a building. They do qualify for tax credits, such as the air source heat pump tax credit 2023, and may also be eligible for additional incentives from specific brands. If you’re considering installing a mini split heat pump, be sure to check the available tax credits and rebates in your area to maximize your savings.

How Does it Work?

To help promote the use of energy-efficient heating and cooling systems, the US government offers tax credits for qualifying mini split heat pumps. These tax credits aim to incentivize homeowners and businesses to choose more environmentally friendly heating and cooling options. Two popular examples of mini split heat pump brands that qualify for tax credits are Mitsubishi and Bosch.

The air source heat pump tax credit is available for qualifying systems installed between January 1, 2017, and December 31, 2023. This credit allows homeowners to claim up to 30% of the cost of purchasing and installing an eligible system, with a maximum credit of $1,500.

When it comes to mini split systems, they may qualify for the tax credit if they meet certain requirements. According to the IRS, the mini split heat pump must be installed in a taxpayer’s primary residence and meet the energy efficiency requirements set by the Department of Energy. These requirements include a minimum Seasonal Energy Efficiency Rating (SEER) of 15 and a Heating Seasonal Performance Factor (HSPF) of 8.5 or higher.

To claim the tax credit, taxpayers need to file IRS Form 5695 along with their federal tax return. This form provides the necessary information to calculate the credit amount. It’s important to keep documentation of the purchase and installation costs, as well as any manufacturer certifications or energy efficiency ratings. This documentation may be required in case of an audit.

It’s worth noting that tax credits are different from tax deductions. While deductions reduce the amount of taxable income, credits directly reduce the amount of tax owed. This means that if a taxpayer qualifies for a $1,500 tax credit, they will owe $1,500 less in taxes.

Before making a purchase, it’s advisable to consult with a tax professional or check the latest IRS guidelines to ensure eligibility for the mini split heat pump tax credit. Taking advantage of available tax credits can help offset the initial cost of installation and make energy-efficient heating and cooling more affordable.

Tax Credits for Mini SplitsBrandsTax Credit

| Mitsubishi | Qualifies for tax credit |

| Bosch | Qualifies for tax credit |

Why Choose a Mini Split Heat Pump?

Mini split heat pumps are becoming increasingly popular for their energy efficiency and versatile heating and cooling capabilities. Here are a few reasons why you should consider choosing a mini split heat pump:

- Energy Efficiency: Mini split systems are highly efficient and can save you significant energy and money on your utility bills. They use advanced technology, such as inverter-driven compressors, to adjust the speed of the motor and provide precise temperature control.

- Tax Credits: Mini split heat pumps qualify for tax credits, making them an even more attractive option. The federal government offers tax credits for certain energy-efficient home improvements, including air source heat pumps. By installing a mini split heat pump, you may be eligible for tax credits that can help offset the cost of the system.

- Versatility: Mini split heat pumps provide both heating and cooling capabilities in one system. They can efficiently cool your home during hot summer months and provide reliable heating during the colder seasons. This versatility makes them a convenient and cost-effective solution for year-round comfort.

- Quiet Operation: Mini split systems are known for their quiet operation. The compressor is located outside, reducing indoor noise levels. This makes mini split heat pumps ideal for bedrooms, living rooms, and offices where noise can be a concern.

- Zone Control: Mini split heat pumps allow for individual temperature control in different rooms or zones. This means you can set different temperatures for each room, saving energy by only heating or cooling the areas that are occupied. Zone control also ensures personalized comfort for everyone in your home.

Brands like Bosch and Mitsubishi offer high-quality mini split heat pumps that qualify for tax credits. By choosing a reputable brand, you can ensure the reliability and efficiency of your system.

In conclusion, mini split heat pumps are an excellent choice for their energy efficiency, tax credit eligibility, versatility, quiet operation, and zone control capabilities. Consider installing a mini split heat pump to save energy, lower your utility bills, and enjoy year-round comfort.

How to Qualify for the Tax Credit

To qualify for the Mitsubishi Mini Split Tax Credit or any other tax credit related to mini-split heat pumps, it is important to understand the eligibility criteria. Here are a few key points to consider:

- Mini-split heat pump – To qualify for the tax credit, your system must be a mini-split heat pump. Traditional split systems or other types of heating and cooling systems may not be eligible.

- Air source heat pump – The tax credit specifically applies to air source heat pumps, which extract heat from the air and transfer it indoors or outdoors to provide heating or cooling. Geothermal heat pumps do not qualify for this tax credit.

- Tax year – The tax credit is available for systems that are “placed in service” between January 1, 2021 and December 31, 2023. This means that the system must have been installed and operational within this timeframe to be eligible.

- Efficiency requirements – The mini-split heat pump must meet specific efficiency requirements to qualify for the tax credit. The minimum energy efficiency ratio (EER) and coefficient of performance (COP) values must be met to be eligible.

- Manufacturer certification – The system must be certified by the manufacturer as eligible for the tax credit. This certification ensures that the system meets the necessary efficiency requirements and other criteria.

It is important to note that tax credits for mini splits, including the mini-split heat pump tax credit, are subject to change and may vary depending on your location. It is recommended to consult with a tax professional or check with your local tax authority for the most up-to-date information.

Claiming the tax credit for mini-splits can help offset the costs of purchasing and installing a more energy-efficient heating and cooling system. It is a great incentive to consider upgrading to a mini-split heat pump system that can provide efficient heating and cooling all year round.

How Much Money Can You Save?

If you are considering purchasing an air source heat pump for your home, you may be eligible for the air source heat pump tax credit in 2023. This tax credit can help you offset the cost of installing a new Mitsubishi mini split system and potentially save you a significant amount of money.

The air source heat pump tax credit allows homeowners to claim a credit on their federal tax return for a portion of the cost of purchasing and installing an eligible heat pump system. The credit is available for systems installed in the taxpayer’s primary residence and can be claimed for both new construction and existing homes.

Under current tax laws, mini-split heat pumps qualify for the tax credit as long as they meet certain energy efficiency requirements. The exact amount of the credit will vary depending on the specific system you choose and the total cost of installation.

It is important to note that the air source heat pump tax credit is a non-refundable credit, meaning it can only be used to offset your tax liability. However, if the credit exceeds your tax liability for the year, you may be able to carry forward the excess credit to future tax years.

To determine the exact amount of money you can save through the air source heat pump tax credit, it is recommended to consult with a tax professional or refer to the instructions provided by the IRS. They will be able to provide you with the most accurate and up-to-date information on claiming the tax credit for your mini-split system.

Overall, taking advantage of the air source heat pump tax credit can help make your investment in a Mitsubishi mini split system more affordable. By reducing your tax liability, this credit can provide significant savings and help offset the cost of installation.

Key Points:

| 1. The air source heat pump tax credit is available in 2023. |

| 2. Mitsubishi mini split systems qualify for the tax credit. |

| 3. The exact amount of the credit will vary depending on the system and installation costs. |

| 4. The tax credit is non-refundable but can be carried forward if it exceeds your tax liability. |

| 5. Consult with a tax professional or refer to IRS instructions for accurate information on claiming the tax credit. |

Step-by-Step Guide to Claiming the Tax Credit

If you have recently installed an air source heat pump, also known as a mini-split system, in your home, you may be eligible for the air source heat pump tax credit. This tax credit is designed to incentivize homeowners to switch to more energy-efficient heating and cooling systems, such as mini-split systems. Here is a step-by-step guide on how to claim the tax credit:

- Make sure your mini-split system qualifies: Before claiming the tax credit, you need to ensure that your mini-split system meets the requirements. According to the IRS, eligible systems must be installed in the taxpayer’s primary residence and meet certain energy efficiency standards.

- Keep all necessary documentation: To claim the tax credit, you will need to have accurate documentation of your mini-split system installation. This includes receipts of purchase, invoices, and any other relevant documents provided by the installer. Make sure to keep these documents in a safe place as you will need them when filing your taxes.

- Determine the amount of the tax credit: The tax credit amount varies depending on the energy efficiency of your mini-split system. The credit can range from $300 to $1,500, so it’s important to know the specific energy efficiency rating of your system to calculate the correct credit amount.

- Claim the tax credit on your tax return: To claim the tax credit, you will need to fill out IRS Form 5695, Residential Energy Credits, and attach it to your federal tax return. This form will require you to provide details about your mini-split system and calculate the tax credit amount you are eligible for.

- Submit your tax return: Once you have completed Form 5695 and calculated the tax credit, you can submit your tax return to the IRS. Make sure to include all relevant forms and documentation to support your claim.

- Monitor your tax refund: After filing your tax return, it’s important to track the progress of your tax refund. You can do this by using the IRS’s online tracking tool or contacting the IRS directly. Keep in mind that the processing time for tax refunds can vary.

- Consult a tax professional: If you are unsure about any step in the process, it’s always a good idea to seek advice from a qualified tax professional. They can guide you through the specific requirements and help ensure that you maximize your tax credit.

By following these steps, you can successfully claim the air source heat pump tax credit for your mini-split system. Remember to keep accurate documentation, calculate the correct tax credit amount, and submit all necessary forms to the IRS. Taking advantage of tax credits for mini splits like Bosch and Mitsubishi can help reduce the cost of your energy-efficient home upgrades.

Important Deadlines

If you are considering purchasing a mini-split heat pump system and want to take advantage of the available tax credits, it is important to be aware of the deadlines associated with claiming these credits. Here are some key dates to keep in mind:

- Tax year deadline: In order to claim tax credits for mini splits, the system must be installed and placed in service by December 31st of the tax year for which you are claiming the credit. This means that the system must be up and running by this date in order to qualify.

- IRS form deadline: Once the mini-split system is installed and placed in service, you will need to fill out IRS Form 5695 – Residential Energy Credits and include it with your annual tax return. The deadline for filing your tax return, including this form, is typically on or around April 15th of the following year.

It is important to note that not all mini-split systems qualify for tax credits. To be eligible, the system must meet certain energy efficiency requirements set by the government. The IRS provides a list of qualifying systems, which includes popular brands such as Bosch and Mitsubishi.

If you are unsure whether your mini-split system qualifies for a tax credit, it is recommended to consult with a tax professional or review the IRS guidelines. Taking advantage of the mini-split heat pump tax credit can help offset the cost of your system and provide long-term energy savings.

Summary of Important Deadlines:DeadlineDescription

| Tax year deadline | The system must be installed and placed in service by December 31st of the tax year. |

| IRS form deadline | IRS Form 5695 must be included with your annual tax return, due around April 15th of the following year. |

Frequently Asked Questions

- What are tax credits for mini splits?

Tax credits for mini splits are incentives offered by the government to homeowners who install energy-efficient heating and cooling systems in their homes. These credits can help reduce the overall cost of purchasing and installing a mini split heat pump.

- Are mini split systems eligible for the air source heat pump tax credit in 2023?

Yes, mini split systems are eligible for the air source heat pump tax credit in 2023. The tax credit allows homeowners to claim a certain percentage of the cost of purchasing and installing a qualifying mini split system as a credit on their federal income tax return.

- Do mini splits qualify for tax credit?

Yes, mini splits qualify for tax credit if they meet the energy efficiency requirements set by the government. To be eligible for the tax credit, the mini split system must meet certain efficiency standards and be installed in the taxpayer’s primary residence.

- Is there a tax credit for Bosch mini split systems?

Yes, there is a tax credit available for Bosch mini split systems. Bosch is a reputable manufacturer of heating and cooling products that meet the energy efficiency requirements set by the government to qualify for tax credits.

- Do mini-split systems qualify for tax credit if they are installed in a second home?

No, mini-split systems do not qualify for tax credit if they are installed in a second home. The tax credit is only available for mini split systems installed in the taxpayer’s primary residence.

- Is there a tax credit for Mitsubishi mini split systems?

Yes, there is a tax credit available for Mitsubishi mini split systems. Mitsubishi is a well-known manufacturer of heating and cooling products that meet the energy efficiency requirements necessary to qualify for tax credits.

Expert Tips for Maximizing Savings

When it comes to maximizing your savings with the mini-split heat pump tax credit, there are a few expert tips you should keep in mind. Here are some things to consider:

- Do mini-split systems qualify for tax credit? Yes, mini-split heat pump systems do qualify for tax credits. These systems are considered energy-efficient upgrades and may be eligible for a tax credit under the Residential Energy Efficient Property Credit.

- Research the specific tax credits for mini splits. While mini-split systems in general qualify for tax credits, it’s important to research the specific requirements and limitations of the tax credit you are eligible for. Different systems may have different efficiency requirements and maximum credit amounts, so be sure to do your homework.

- Consider Mitsubishi mini split tax credit. Mitsubishi is a leading brand of mini-split heat pump systems, and they often offer tax credits for their products. If you’re considering purchasing a Mitsubishi mini split system, be sure to check if they have any current tax credit promotions available.

- Maximize your savings by combining tax credits. In addition to the tax credit for mini-split systems, there may be other tax credits or incentives available for energy-efficient upgrades. For example, you may also be eligible for a tax credit or rebate for installing a Bosch mini split system. Take advantage of any additional savings opportunities to maximize your overall savings.

- Keep detailed records and documentation. To ensure you qualify for the full tax credit amount, be sure to keep detailed records of your mini-split system purchase and installation. This includes receipts, invoices, and any relevant product or installation documentation. These records may be required when filing your taxes and claiming the tax credit.

By following these expert tips, you can maximize your savings with the mini-split heat pump tax credit. Remember to research the specific requirements and limitations of the tax credit you are eligible for, and keep detailed records to ensure a smooth and successful tax credit claim process.

Additional Incentives and Rebates

In addition to the federal tax credit for mini-split heat pumps, there may be additional incentives and rebates available at the state and local level. These incentives can help offset the cost of purchasing and installing a mini-split heat pump system.

Here are some examples of additional incentives and rebates you may be eligible for:

- Bosch Tax Credit: Bosch offers a tax credit for their mini-split heat pump systems. This tax credit can help reduce the overall cost of purchasing and installing a Bosch mini-split heat pump.

- Mitsubishi Mini Split Tax Credit: Mitsubishi also offers a tax credit for their mini-split heat pump systems. This tax credit is available for both residential and commercial installations.

- State and Local Incentives: Many states and local utilities offer additional incentives and rebates for energy-efficient home improvements, including mini-split heat pumps. These incentives can vary greatly, so it’s important to research what is available in your area.

- Manufacturer Rebates: Some manufacturers may offer their own rebates on mini-split heat pumps. These rebates can help further reduce the upfront cost of purchasing and installing a system.

It’s important to note that not all mini-split heat pump systems qualify for tax credits or incentives. To be eligible for these incentives, the system must meet certain energy efficiency requirements and be installed by a licensed professional. It’s always best to consult with a tax professional or HVAC contractor to determine if the system you are considering qualifies for any available tax credits or incentives.

Energy Efficiency Benefits

Installing an air source heat pump in your home not only helps reduce your carbon footprint but also offers significant energy efficiency benefits. With the increasing popularity of mini-split systems, you may wonder if they qualify for the air source heat pump tax credit in 2023. The answer is yes! Mini-split systems are eligible for the tax credit, providing you with additional savings on top of the energy efficiency benefits.

Here are some key points to consider regarding tax credits for mini splits:

- Qualification: Mini-split heat pumps, including Mitsubishi mini splits, qualify for the tax credit. This means that you can claim the mini-split heat pump tax credit when you install a qualifying system in your home.

- Savings: The mini-split heat pump tax credit allows you to claim a certain percentage of the cost of the system, up to a specified limit. This can result in significant savings on your tax bill, making the installation of a mini-split system even more cost-effective.

- Energy Efficiency: Mini-split systems are known for their energy efficiency. They use advanced technology to heat and cool your home while consuming less energy compared to traditional HVAC systems. This not only helps reduce your utility bills but also contributes to a greener environment.

By taking advantage of the air source heat pump tax credit for mini splits, you can enjoy the benefits of energy efficiency while saving money on your taxes. It’s a win-win situation that encourages homeowners to invest in more sustainable and cost-effective heating and cooling solutions.

If you’re considering installing a mini-split system, make sure to check the eligibility requirements for the tax credit and consult with a qualified HVAC professional who can guide you through the process.

Investing in energy-efficient technologies like mini-split systems not only helps you save money but also plays a crucial role in combating climate change and preserving our planet for future generations.

Table: Eligibility Requirements for Mini-Split Heat Pump Tax Credit

RequirementDetails

| System Type | Mini-split heat pump |

| Installation Year | 2023 |

| Tax Credit Percentage | Up to a specified limit |

| Claiming Process | Refer to the IRS guidelines for claiming the tax credit |

Make sure to consult with a tax professional or visit the official IRS website for the most up-to-date information on the mini-split heat pump tax credit and how to claim it.

Long-Term Cost Savings

Investing in a mini-split heat pump system not only provides immediate benefits in terms of comfort and energy efficiency, but it can also lead to significant long-term cost savings. Additionally, taking advantage of the available mini-split heat pump tax credit can further enhance these savings.

With the mini split tax credit, homeowners can receive a financial incentive for purchasing and installing energy-efficient mini-split systems. This can help offset the initial cost of the system and make it more affordable for homeowners.

Mitsubishi mini split tax credit and Bosch tax credit, among others, are examples of the tax credits available for mini-split heat pumps. It’s important to note that tax credits for mini-splits can vary depending on factors such as the model, energy efficiency rating, and installation date. Homeowners should consult the IRS guidelines or a tax professional to determine if their mini-split system qualifies for tax credit.

By taking advantage of the mini-split heat pump tax credit, homeowners can significantly reduce their upfront costs and enjoy the long-term benefits of energy-efficient heating and cooling. Over time, these systems can help lower energy bills and decrease overall energy consumption, resulting in substantial cost savings.

Mini-split systems are known for their energy efficiency, as they allow for targeted temperature control in individual rooms or zones. This means that homeowners can heat or cool only the spaces that are currently occupied, rather than wasting energy on heating or cooling the entire home.

Additionally, mini-splits use advanced technologies such as inverter compressors, which adjust the speed and power output to match the heating or cooling demand. This results in more precise temperature control and reduced energy consumption compared to traditional HVAC systems.

Furthermore, mini-split systems are designed for easy maintenance and have a longer lifespan compared to other heating and cooling systems. Regular maintenance and upkeep can ensure optimal performance and efficiency, helping to maximize the cost savings over time.

In summary, investing in a mini-split heat pump system and taking advantage of available tax credits can lead to significant long-term cost savings. Not only do these systems provide immediate benefits in terms of comfort and energy efficiency, but they also offer the advantage of lower energy bills and decreased energy consumption over time.

Choosing the Right Mini Split Heat Pump

When it comes to selecting a mini split heat pump for your home, there are several factors to consider. Not only do you want to choose a system that meets your heating and cooling needs, but you also want to take advantage of any available tax credits.

As of 2023, there is an air source heat pump tax credit available for homeowners who install energy-efficient HVAC systems. This tax credit is designed to incentivize the use of mini-split heat pumps and other environmentally friendly heating and cooling options.

Before making a purchase, it’s important to check if the mini-split heat pump you are considering qualifies for the tax credit. Not all models are eligible, so be sure to do your research and confirm that the system you are interested in meets the necessary requirements.

Two popular brands that offer tax credits for mini split systems are Bosch and Mitsubishi. Both companies have a wide range of energy-efficient heat pumps that are eligible for the tax credit. Additionally, they offer reliable and high-quality products that are designed to provide both heating and cooling capabilities.

When choosing a mini split heat pump, consider factors such as the size of the area you need to heat or cool, the energy efficiency rating of the system, and any additional features that may be important to you. It’s also a good idea to consult with a professional HVAC installer to ensure that you choose the right system for your specific needs.

The installation of a mini-split heat pump can provide numerous benefits for homeowners, including energy savings, improved comfort, and reduced environmental impact. By taking advantage of the available tax credits, homeowners can make the investment in a mini split heat pump even more affordable.

Key Points when Choosing a Mini Split Heat Pump:ConsiderationsTax Credit Eligible Brands

| Size of the area you need to heat or cool | Bosch, Mitsubishi |

| Energy efficiency rating | Bosch, Mitsubishi |

| Additional features | Bosch, Mitsubishi |

By choosing the right mini-split heat pump and taking advantage of the available tax credits, homeowners can enjoy cost savings on their energy bills and contribute to a more sustainable future.

Professional Installation Services

When it comes to claiming your mini-split heat pump tax credit, it’s important to ensure that the installation is done correctly. Not only will this maximize the efficiency and performance of your system, but it will also ensure that you qualify for any applicable tax credits.

Mini-split systems are eligible for tax credits, but it’s important to note that not all installations will qualify. The Internal Revenue Service (IRS) has specific requirements that must be met in order to claim the tax credit. These requirements include:

- The mini-split system must be installed in your primary residence.

- The system must meet certain energy efficiency criteria, such as a minimum Seasonal Energy Efficiency Ratio (SEER) and Heating Seasonal Performance Factor (HSPF).

- The system must be installed by a qualified professional.

By hiring a professional installation service, you can ensure that your mini-split system meets all of the necessary requirements for the tax credit. Not only will this save you time and effort, but it will also give you peace of mind knowing that your system is installed correctly and efficiently.

When selecting a professional installation service, it’s important to choose a company that has experience with mini-split systems and is familiar with the tax credit requirements. Look for a reputable company that is licensed and insured, and ask for references or testimonials from satisfied customers.

By investing in professional installation services, you can take advantage of the tax credits for mini splits and enjoy the benefits of a highly efficient heating and cooling system in your home.

Bosch Tax Credit: If you choose to install a Bosch mini-split heat pump system, you may be eligible for additional tax credits. Bosch offers a Federal Tax Credit of up to $500 per system, as well as potential state and utility rebates.

Air Source Heat Pump Tax Credit 2023: The air source heat pump tax credit is currently available for qualifying systems installed before December 31, 2023. The credit amount is subject to change and should be confirmed with the IRS or a tax professional.

In conclusion, professional installation services for mini-split heat pump systems are crucial when it comes to claiming the tax credit. By ensuring that your system is installed correctly and meets all necessary requirements, you can maximize your energy savings and qualify for any available tax credits.

Warranty and Maintenance Services

As you consider installing a mini split heat pump in your home, it’s essential to understand the warranty and maintenance services that come with it. These services can help protect your investment and ensure that your mini split heat pump operates efficiently for years to come.

Most reputable manufacturers, such as Bosch and Mitsubishi, offer warranties on their mini split systems. These warranties typically cover defects in materials and workmanship for a specified period, providing you with peace of mind in case any issues arise. It’s always a good idea to carefully review the warranty terms and conditions to understand what is covered and for how long.

In addition to warranty coverage, regular maintenance is crucial for the optimal performance of your mini split heat pump. Routine maintenance helps prevent breakdowns, ensures energy efficiency, and extends the lifespan of your system. While some homeowners may choose to perform basic maintenance tasks themselves, it’s advisable to have a professional HVAC technician inspect and service your mini split heat pump at least once a year.

When it comes to tax credits for mini splits, it’s worth noting that not all systems qualify. To be eligible for the federal tax credit, your mini split heat pump must meet certain criteria, such as being an air source heat pump and meeting efficiency requirements. It’s important to consult with a tax professional or refer to official IRS guidelines to determine if your mini split heat pump qualifies for tax credits. The tax credit for mini splits is available until the end of 2023.

In conclusion, understanding the warranty and maintenance services available for your mini split heat pump is essential for ensuring its long-term performance and protecting your investment. Be sure to review the warranty terms, schedule regular maintenance with a professional technician, and consult with a tax professional to determine if your system qualifies for any tax credits.

Contact Us for More Information

If you have questions about whether mini-split systems qualify for tax credit, or if you would like more information about the mini-split heat pump tax credit, our team is here to help.

At [Your Company Name], we understand the importance of saving money and taking advantage of available tax credits. That’s why we want to provide you with all the information you need to make an informed decision.

Whether you’re interested in the Mitsubishi mini split tax credit or want to know if mini splits qualify for tax credit in general, our knowledgeable professionals can assist you.

We can guide you through the process of determining if you’re eligible for tax credits for mini splits and help you understand the requirements. Our team is up-to-date on the latest tax regulations and can provide accurate information on air source heat pump tax credit for the year 2023.

We are committed to excellent customer service and will answer any questions you may have. Contact us today for more information. Give us a call or send us a message – we’re here to help!

Contact Information:

- Phone: [Your Phone Number]

- Email: [Your Email Address]

- Website: [Your Website URL]

Q&A:

What is a mini split heat pump?

A mini split heat pump is a type of heating and cooling system that consists of an outdoor unit and one or more indoor units. It can provide both heating and cooling to a single zone or multiple zones in a home or building.

How does a mini split heat pump work?

A mini split heat pump works by transferring heat between the indoor and outdoor units using refrigerant. In heating mode, it extracts heat from the outdoor air and transfers it indoors, while in cooling mode, it removes heat from the indoor air and transfers it outdoors.

What are the advantages of a mini split heat pump?

There are several advantages of a mini split heat pump. It offers energy-efficient heating and cooling, as well as the ability to customize the temperature in different zones. It is also easy to install and does not require ductwork, making it ideal for retrofitting older homes or adding climate control to specific rooms.

How can I claim the mini split heat pump tax credit?

You can claim the mini split heat pump tax credit by filing Form 5695 with your federal income tax return. The tax credit is equal to a percentage of the cost of the equipment and installation, up to a certain limit. Be sure to keep all receipts and documentation related to the purchase and installation of your mini split heat pump for tax purposes.